do you pay taxes on inheritance in north carolina

Do beneficiaries have to pay taxes on inheritancedank memer lifesaver. In the US 32 states do not apply death taxeseither inheritance or estate taxesbut there are reasons you still might get hit with a bill.

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

On the form you state that the value of the estates personal property everything but real estate is less than 20000 or less than 30000 if the surviving spouse inherits everything under state law and that at least 30 days have passed since the persons death.

. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million. There is no capital gains tax in North Carolina. Do you have to pay estate tax in North Carolina.

American standard wall sink. There is no inheritance tax in NC. If you inherit money willed to you in the state of North Carolina you must pay taxes on the money.

Inheritance taxes are more than regular employee taxes. Where to go for more help with inheritance income. However - there is no inheritance taxes on neither federal nor state level in North Carolina.

North Carolina does not collect an inheritance tax or an estate tax. How many trophies does messi have in. North Carolina does not collect an inheritance tax or an estate tax.

Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. North Carolina does not collect an inheritance tax or an estate tax. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is.

There is no inheritance tax in North Carolina. When you are receiving an inheritance you may wonder if you are required to pay a tax on the inheritance. What are the rules for probate in North Carolina.

No Inheritance Tax in NC. The gains are included as income and taxed at the flat income tax rate of 525. What is rutgers known for academically.

The inheritance tax of another state may come into play for those living in North Carolina who inherit money. Despite the inheritance tax repeal which gives north carolina residents the benefit of the full applicable credit amount for transfers at death north carolina has not fully unified its estate and gift tax system. Do beneficiaries have to pay taxes on inheritance.

When a loved one or benefactor dies and leaves property or money to you you might have to pay inheritance and estate taxes on it. Although theres no rule that says you cant gift inherited property to someone you cant do so without paying the proper taxes on it. Estate taxes are imposed on the total value of the estate - if the total estate value is large enough - the executor executor of the estate must file federal and a North Carolina estate tax returns and pay any tax due within 9 months after the death.

Do beneficiaries have to pay taxes on inheritance. My health sm north doctors schedule. While 2010 has an unlimited exemption with the tax repealed you will only be able to have a 1000000 exemption starting in 2011 with a 55 percent maximum estate tax on values over.

Posted on February 11 2022 by. The answer is probably not. Calculate how much tax will be owed on your estate upon your death.

The inheritance tax of another state may come into play for those living in North Carolina who inherit money. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state. Leeds united team 2019.

The threshold for decedents. These are some of the taxes you may have to think about as an heir. Inheritance tax is a state tax only.

Home Sale Tax Exclusion. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state. When you are receiving an inheritance you may wonder if you are required to pay a tax on the inheritance.

If you die intestate each of your children receives an intestate share of your property. However there are sometimes taxes for other reasons. These are some of the taxes you need to think about as an heir.

This should include the Federal Estate Transfer Tax as well as state inheritance taxes. The recipient of an inheritance is not going to be paying transfer taxes on the inheritance unless there is an inheritance tax in the state within which the recipient resides. Do you pay taxes on inheritance in North Carolina.

North Carolina does not collect an inheritance tax or an estate tax. However sometimes there are taxes for other reasons. There is no inheritance tax in north carolina.

Even though gifting the home isnt a good way to dodge the taxes there are some legal tax exclusions that you might find helpful. You might inherit 100000 but you would pay an inheritance tax on just 50000 if the state only imposes the tax on inheritances over 50000. There is no inheritance tax in North Carolina.

However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million. However there are sometimes taxes for other reasons. Only six states have an inheritance tax though Kentucky is one of them.

Do you have to pay estate tax in North Carolina. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state. The inheritance tax of another state may come into play for those living in North Carolina who inherit money.

There is no inheritance tax in North Carolina. There is no inheritance tax in North Carolina. Tax Exclusions for Selling Inherited Property.

No estate tax or inheritance tax North carolina does not collect an inheritance tax or an estate tax. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is. If you live in a state that does have an estate tax you may be expected to pay the death tax on the money you inherit from a death in NC.

In north carolina you are not required to pay state estate tax or inheritance tax.

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

What North Carolina Residents Need To Know About Federal Capital Gains Taxes

North Carolina Gift Tax All You Need To Know Smartasset

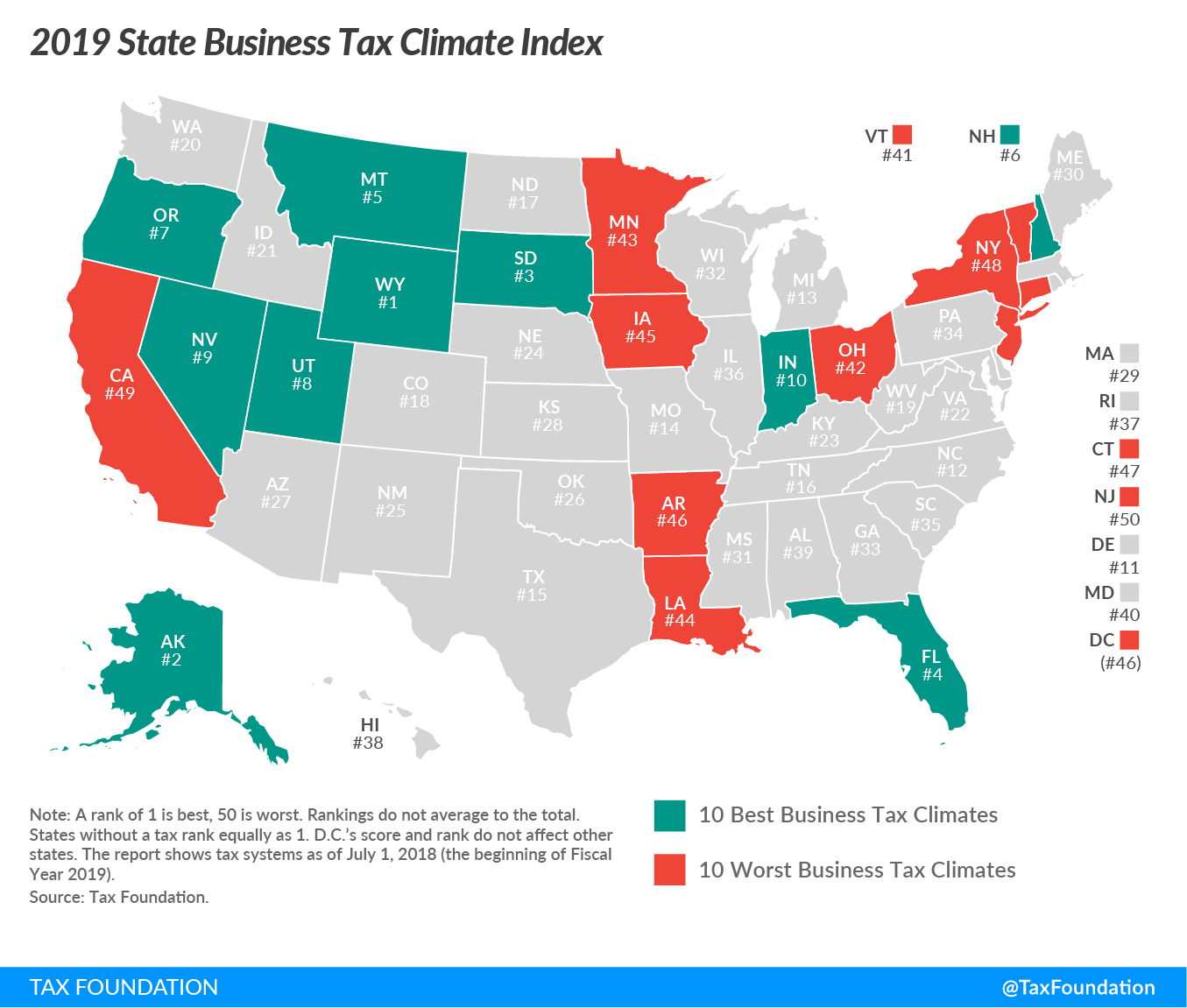

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

North Carolina Estate Tax Everything You Need To Know Smartasset

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas